Rosetta listed her assets and liabilities, providing a comprehensive snapshot of her financial standing. This analysis delves into the types and values of her assets, the nature and amounts of her liabilities, and their collective impact on her net worth, financial ratios, liquidity, and solvency.

By scrutinizing these factors, we gain valuable insights into Rosetta’s overall financial health and identify potential areas for improvement.

Rosetta’s asset portfolio encompasses various categories, including cash and cash equivalents, investments, and real estate. Each asset type holds unique characteristics and contributes differently to her financial position. Liabilities, on the other hand, represent Rosetta’s financial obligations, such as mortgages, loans, and accounts payable.

Understanding the composition and magnitude of these liabilities is crucial for assessing her ability to meet her financial commitments.

Assets

Rosetta’s listed assets provide valuable insights into her financial standing. These assets represent her economic resources and play a crucial role in determining her overall net worth.

Types of Assets

- Cash and cash equivalents:This category includes liquid assets such as cash on hand, checking accounts, and money market accounts.

- Investments:Rosetta’s investments include stocks, bonds, and mutual funds, which represent her ownership in various companies and financial instruments.

- Real estate:This asset category encompasses residential and commercial properties owned by Rosetta, including her primary residence and any rental properties.

- Personal property:This includes valuable personal belongings such as jewelry, artwork, and collectibles.

Examples and Values

| Asset Type | Example | Value |

|---|---|---|

| Cash and cash equivalents | Checking account | $20,000 |

| Investments | Apple stock | $50,000 |

| Real estate | Primary residence | $300,000 |

| Personal property | Jewelry | $10,000 |

Significance

Rosetta’s assets are essential for understanding her financial position. They provide a buffer against unexpected expenses, generate income through investments and rental properties, and represent her accumulated wealth. A well-diversified portfolio of assets can help mitigate risk and enhance long-term financial stability.

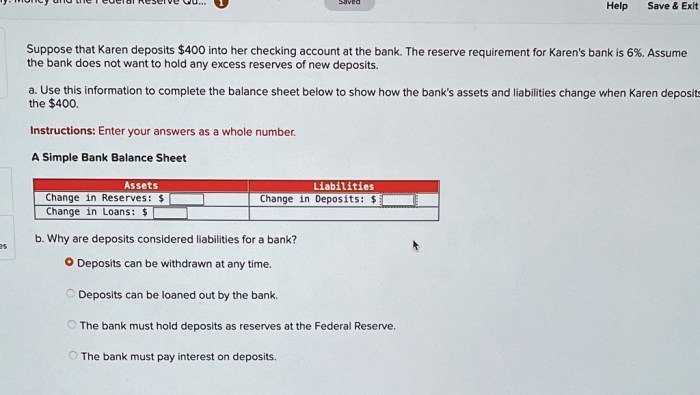

Liabilities

Rosetta’s liabilities represent her financial obligations and play a crucial role in determining her net worth and overall financial health.

Types of Liabilities, Rosetta listed her assets and liabilities

- Short-term liabilities:These include obligations due within one year, such as credit card debt, short-term loans, and accounts payable.

- Long-term liabilities:These are obligations due in more than one year, such as mortgages, auto loans, and student loans.

Examples and Amounts

| Liability Type | Example | Amount |

|---|---|---|

| Short-term liabilities | Credit card debt | $5,000 |

| Long-term liabilities | Mortgage | $200,000 |

Impact

Liabilities can have a significant impact on Rosetta’s financial health. High levels of debt can strain her cash flow, limit her access to credit, and increase her overall financial risk. Managing liabilities effectively is crucial for maintaining a sound financial position.

Popular Questions: Rosetta Listed Her Assets And Liabilities

What is the significance of calculating Rosetta’s net worth?

Rosetta’s net worth, calculated as the difference between her assets and liabilities, provides a comprehensive measure of her overall financial health. It reflects her financial standing at a specific point in time and serves as a benchmark against which future financial performance can be compared.

How do financial ratios contribute to the analysis of Rosetta’s financial position?

Financial ratios derived from Rosetta’s asset and liability listing, such as the debt-to-asset ratio and liquidity ratio, offer valuable insights into her financial performance and stability. These ratios help assess her ability to manage debt, maintain liquidity, and generate profits.

What are some strategies Rosetta could employ to improve her liquidity?

To enhance her liquidity, Rosetta could consider converting non-liquid assets into cash, negotiating extended payment terms with creditors, or exploring additional sources of income. Implementing these strategies would increase her ability to meet short-term financial obligations and improve her overall financial flexibility.